Abstract

We provide a rapid approach to the evaluation of new product ideas and opportunities through the science of Mind Genomics. The approach requires the specification of a product or opportunity, the creation of four questions which ‘tell a story,’ each with four answers (total of 16 answers), and the evaluation of combinations of the answers by a small, affordable group of 25 respondents. We look at the ratings for ‘most interested’ (top of the scale), identify mind-sets, and discover what ideas both interest people (opportunities), and engage people when thinking about them. We uncover new-to-the-world groups (high acceptor mind-sets) to identify which ideas about the new product are most compelling, and search for these high-acceptor mind-sets using a simple, 6-question personal viewpoint identifier. The approach is designed for rapid use, requiring a day or two at most, thus targeting the newly emerging cadre of food entrepreneurs who are not hampered by the traditional processes designed to reduce risk rather than capture opportunities.

Introduction

There is a continuing search for healthful snacks. The increasing and massively competitive focus on good-for-you, along with the knowledge that it is good tasting to ensure repeat purchase, means that the food company must develop efficient ways to screen new ideas. Over the decades, solution-providers in the food industry, particularly, but consumer package goods generally, have explored various ways to create new product ideas, ranging from the evaluation of different ideas (promise testing) to the assessment of concepts, with and without the presence of a product. The results of the effort have not been successful, perhaps because the researcher does not understand in depth the features of the product concept which make it attractive. Even focus groups, specifically called to ferret out the features which the product should have often do not identify what the product should be.

Part of the reason for failure or at least for the failure to succeed, is the tendency of researchers to create combinations with which they are comfortable, and to avoid creating product ideas or prototypes that they think will ‘fail.’ That is, there is an insidious drive for rationality in people, especially brand managers, but also market researchers and product developers. In the face of market failure, it is hard to accept that one’s ideas of what is a good product must have been wrong. Blame is cast upon sales, distribution, advertising, not upon the fact that the research approach simply came up with the wrong idea, an idea that ended up getting adopted and losing money when the manufacturer puts the product to the real test, the jury of public opinion. This desire not to be embarrassed by offering ‘bad test stimuli’ in the name of progressing the project can derail even the best of teams, as individuals think of themselves first, and only later of the project success.

Testing ideas for new and healthful products might take a lesson from the great American inventor, Thomas Edison, who used failure as a springboard to success. Each failure, in the mind of Edison, was something from which a lesson could emerge. What would happen to the creation of new and healthful ideas about food if we were to systematize the invention process, not so much in the systematic, lock-step way that systems current do (e.g., Stage Gate, Cooper, 1979; 1990) [1,2], but rather as a system to create combinations, see how they work, and move on? The creation of combinations should not be done by a person who is doing the thinking, but rather through experimental design, the systematic, statistics-driven method of making combinations of variables.

The food industry is plagued by a continuing spate of failures, often failures of a single unusual flavor in an otherwise successful line, but occasionally a massive ‘flame out,’ a major line of brands simply crashing. Professionals and the trade in the food industry accept this failure, assuming it is now part of the reality of the food business. High failure rates may be the result of the structure of the business, but they are also the result of desires to get products into the market for the gratification and resumes of brand manager, as well as the need to announce ongoing ‘innovation’ to the investors and to those in the stock market.

It may well be that part of the problem of today is the perfect storm of risk-aversion, ossified process of new product development, and a knowledge-acquisition system (market research insights, sensory testing) which itself is stultifying, substituting statistical rigor for intellectual acuity and competence. In other words, the system is ‘broken,’ aged, simply not working today because it was designed for yesterday’s slower, less competitive reality.

If one is to believe experts in other areas, such as perfume, and even the new crop of entrepreneurs in the food industry, one might walk away with the belief that the cause of failure is an over-reliance on so-called mindless or ‘insight-less’ consumer research. The expert perfumer, so-called ‘golden nose’ has the reputation of averring that her or his nose, ‘knows what the consumer wants. In the same way, many entrepreneurs ‘know’ what their prospective customers want. They may not have data, but they are swept up in the excitement, the abandon, and the oft-hidden hubris of their own efforts.

The Need for Data but the Complementary Need for Agility

Data are required for new products, especially for ideas, but how does one get these data in a rigorous, rapid, cost-effective manner. There are some who believe that a series of focus groups are the cost-effective way. Others belief that following the market and looking at trends will be the answer. Most believe that agility is key and talk about the need for a better process [3–6]. It is fine to talk about the need for agility, for data, for better decision processes, for more successes, but simply what does one do at a local, operational level, in the day to day world of product design?

The Mind Genomics Approach

The answer may lie in systematic, inexpensive research, in experimental design of combinations of test stimuli. The ratings of these stimuli, properly collected and analyzed, may give us part of the answer. This paper presents a short case history of the approach. It is based upon decades of work, which have led to products such as the Oral B Electric Toothbrush (1992), the Discover Card Cash Back Credit Card (1993), successful jewelry promotions by Kay Jewelers (1997), MasterCard (1007–2006), and ongoing efforts since then in the reduction of hospital readmissions in the case of congestive heart failure (Moskowitz & Gofman, 2018; Moskowitz, 2016, unpublished.)

Mind Genomics is an emerging science, focusing on the science of the everyday. The foundation of Mind Genomics comes from the fields of experimental psychology, consumer research, and conjoint measurement [7–9] Experimental psychology provides the world view, namely explore and define the relation between stimulus and response, rather than using statistical methods to understand large-scale, cross-sectional data. Through experimentation one understands how one variable affects another. Consumer research focuses on the everyday, the quotidian aspects of life, how we make decisions about things that we do, choose, purchase, and so forth. Consumer research provides the general focus, dealing with the normal, not the unusual, and not the strained ‘normalcy’ that must be done by experimental psychologists when they study behavior. Finally, conjoint measurement [10] brings in the use of experimental design, systematic combinations of variables, to understand choice, as these variables compete with each other, and add to each other to drive responses [11–13].

Mind Genomics as it is currently constituted approaches the problem of new product design in a straightforward manner. The governing notion is that one should pose a general topic (e.g., what are the features of a new, vegetable-based muffin for the health market, the topic studied here.) The researcher should then deconstruct the topic into four questions which ‘tell a story.’ This step can be hard or easy, depending upon the topic, the experience of the researcher. Finally, each question should generate four simple answers, phrased in declarative format. This third step is quite easy. It is the formulation of the four questions which is difficult. The approach is decades old, beginning in industrial applications in the early 1980’s by author Moskowitz, and evolving to a so-called DIY (Do It Yourself) technology in early 2000 [14,15].

Method

The mechanics of Mind Genomics are, by now, well-choreographed. The steps below fit very well into the innovation process, as should become obvious.

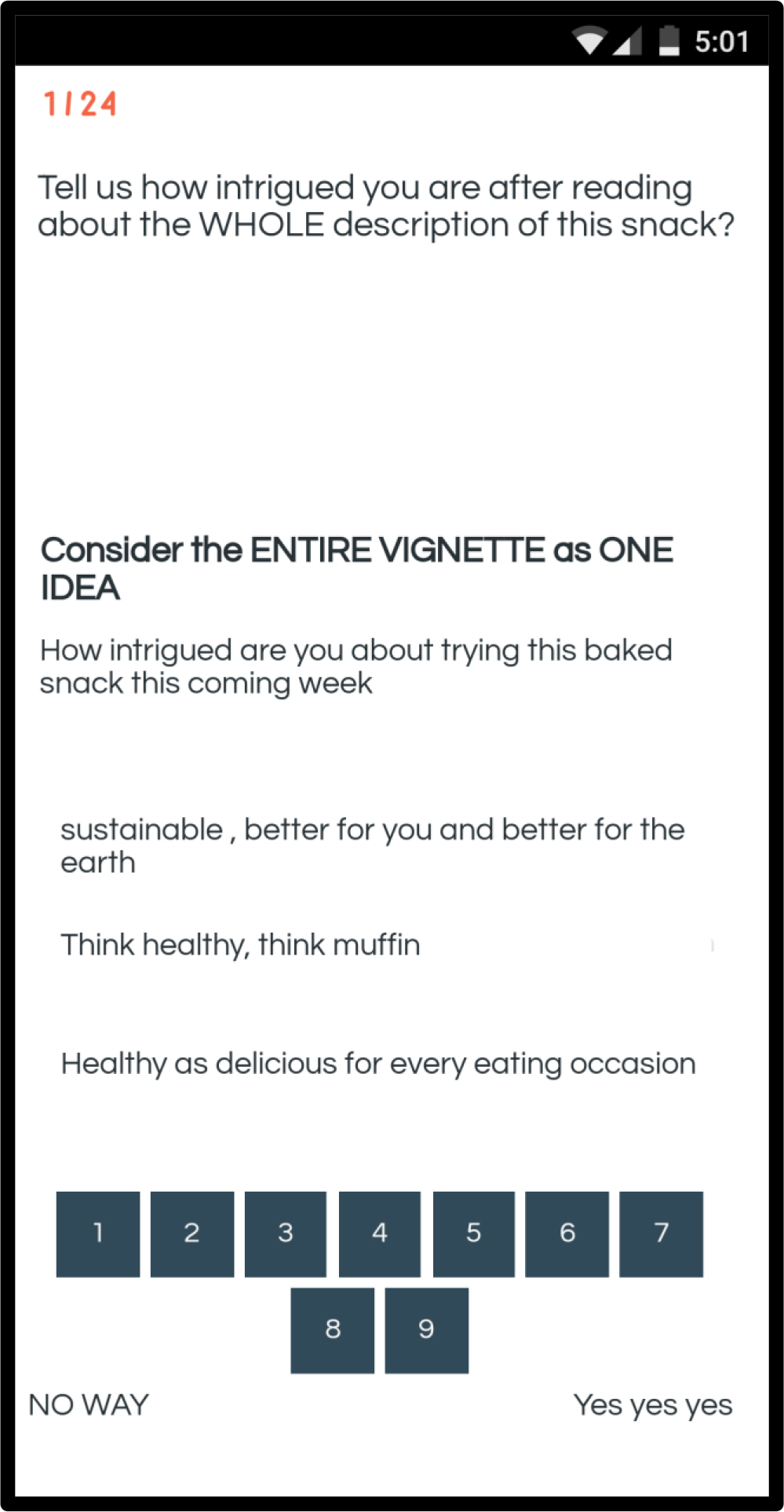

- Identify the Topic, Ask the Questions, and Present Four Answers: Table 1 presents the four questions, and the four answers to each question. Note that the question is only a heuristic to guide the creation of answers. Sometimes the answers are ‘off target,’ but that is irrelevant. It is important to keep in mind that the respondent will never see the questions. The respondent will only see the answers.

- Recruit Respondents to Participate, by Email Invitation: The omnipresence of the Internet has enabled researchers to do many types of studies on the Web, without having to meet the respondents. Panel companies have emerged to service the business of recruiting and provided participants for these studies. The past 20 years, the period of massive growth in the use of the Internet, has affected researchers as well. Much research is done on the web, but it is increasingly difficult to recruit respondents to participate, when these respondents come from one’s own list of contacts. The panel providers (here strategic partner, Luc.id, Inc.) guarantee the proper respondents. This study was done with 25 respondents, enough to provide statistically powerful answers through back-end regression modeling, albeit at an affordable price, and very rapidly (1–2 hours for the entire process, from setting up the study to receiving the PowerPoint report, ready for presentation.)

- Orient the Respondents: Present the respondents with an orientation page, telling them what the study is about. The sentence below reflects all the information that the respondent receives. It is good practice for the respondent to receive as little information as possible. In such a case, it is the set of elements which ‘drive’ the responses, and not any predetermined set of expectations.

How intrigued are you about trying this baked snack this coming week: 1=NO WAY … 9=Yes yes yes

Table 1. The four questions, and the four answers to each question.

Question A: why do we need vegetables?

A1

Sustainable, better for you and better for the earth

A2

Vegetable are delicious

A3

Vegetables are very healthful for you

A4

Vegetables prevent health problems

Question B: How to make vegetables appetizing & delicious to you?

B1

Delicious to eat and good for your body

B2

Think healthy, think muffin

B3

Global and adventurous eating

B4

Vegetable for all ages

Question C: what will eating vegetable do for you?

C1

Lovingly created vegetable baked snacks

C2

A delicious way to great health

C3

Healthy as delicious for every eating occasion

C4

Convenient on-the-go snack

Question D: how to make it fun to eat vegetable?

D1

Real food created by mom and real baker

D2

Made from the ingredients found in your own kitchen

D3

Customized in four flavors: cauliflower, chocolate pomegranate, carrot morning glory, garden vegetable

D4

This is gluten free and all natural

- Respondent Evaluates Systematically Varied Combinations (Vignettes): Each respondent evaluates 24 vignettes, a vignette comprising 2–4 elements, at most one element or answer from each question, but sometime no elements or answers from a question. The structure of the experimental design ensures that each element appears an equal number of times, and that the set of 16 elements are statistically independent of each other. The statistical independence allows for the application of OLS (ordinary least-squares) regression to relate the presence/absence of the 16 elements to the binary transformed rating (whether Top3, Top2 or Top1, respectively.) Furthermore, each respondent evaluated a different set of 24 vignettes. The underlying design is the same for each respondent [15,16]. Only the specific combinations change. This change in the combinations, maintaining, however, the basic structure of the design, is akin metaphorically to the ‘MRI’ in medicine, which takes different pictures of the same structure, and then recombines these pictures to give a 3-dimensional rendering of the structure. Figure 1 presents an example of a vignette as it would appear on the screen of a smartphone, making it possible to do research anywhere in the world, in almost any situation.

Figure 1. Example of a vignette as it would appear on the screen of a smartphone.

- Prepare the Data for Statistical Analysis: Mind Genomics studies are set up to be analyzed using OLS (ordinary least-squares) regression. The independent variables are the presence/absence of the 16 ‘answers.’ The variables are coded 0/1 to reflect the fact that we are only interested in the effect that they have when they are present in a vignette versus absent from a vignette. They have no intrinsic numerical value. The dependent variable is a recoding of the original 9-point scale. The rationale for re-coding is that in practice, most researchers and business managers do not know how to interpret the numbers on a Likert scale. They do know how to interpret binary numbers (no/yes, bad/good). The rescaling or recoding of the ratings was done with three different criteria, to generate three new dependent variables:

Top 3 – Ratings of 1–6 recoded as 0, ratings of 7–9 recoded as 100. This is the typical recoding, following standard practices in consumer research.

Top 2 – Ratings of 1–7 recoded as 0, ratings of 8–9 recoded as 100. This is a more stringent characterization of ‘good’, because only two of the rating points are now ‘good.’

Top 1 – Ratings of 1–8 recoded as 0, ratings of 9 recoded as 100. This is the most stringent characterization of ‘good,’ because only one rating point is ‘good,’ the highest rating. This will become the preferred approach here because it rapidly eliminates weaker ideas, even when the population of respondents tends to ‘uprate’ the vignettes as is often the case in other cultures, such as respondents in Latin America and in the Philippines. The uprated combinations give the research false positives.

- Estimate the Additive Constant and the 16 Coefficients, One for Each of the Answers: Our first analysis from OLS regression appears in Table 2, which compares the coefficients from the model when the three different dependent variables are estimated using the same 16 predictor variables.

Table 2. Coefficients for the OLS model relating acceptance on the 9-point scale to the presence/absence of elements. Stringency of acceptance was defined at three different levels,

TOP 1

TOP 2

TOP 3

Stringency for approval – levels of the 9-point scale leading to a value of 100

High 9

Med 8, 9

Low 7, 8, 9

Additive constant

25

34

58

C4

Convenient on-the-go snack

6

2

0

D2

Made from the ingredients found in your own kitchen

4

4

4

A1

Sustainable, better for you and better for the earth

1

1

0

A3

Vegetables are very healthful for you

1

8

5

A4

Vegetables prevent health problems

1

3

1

D1

Real food created by mom and real baker

1

3

1

A2

Vegetables are delicious

0

1

-4

C2

A delicious way to great health

0

5

1

C1

Lovingly created vegetable baked snacks

-1

4

3

C3

Healthy as delicious for every eating occasion

-1

-4

1

B2

Think healthy, think muffin

-2

-2

-8

D4

This is gluten-free and all-natural

-2

3

5

D3

Customized in four flavors: cauliflower, chocolate pomegranate, carrot morning glory, garden vegetable

-3

2

7

B3

Global and adventurous eating

-4

-3

-3

B4

Vegetables for all ages

-4

1

-5

B1

Delicious to eat and good for your body

-5

8

-1

The additive constant estimates the percent of times that a rating would be assigned either 9 (Top1), 8 or 9 (Top 2), or 7, 8 or 9 (Top3). The results from the OLS regression suggest a modest additive constant when the most stringent criterion is adopted (constant = 25), and a high additive constant when the most lenient, least stringent criterion is adopted (Constant = 58 for Top3). We interpret this to mean that when we use a tough criterion (only rating of 9), we get about 25% of the responses to be 9 in the absence of elements. This is a very encouraging result. It suggests that the notion of a vegetable-based muffin is, by itself, is a very good idea. When we reduce the strictness, the additive constant jumps to 58, meaning that in the absence of elements, almost 60% of the responses will be positive, even before the elements are introduced.

Thus far the data suggest strong positive feeling to the basic idea of a vegetable-based muffin. The additive constants are high. Even when we impose the greatest stringency, 9 to become 100, else 0, we find that a full 25% of the time we would we expect a positive reaction to the concept of a vegetable muffin.

When we move to the performance of the individual elements, we do not see any very strong performers, No element really stands out when we adopt the most stringent criterion. The only element which performs well is ‘convenient, on-the-go snack.’ As we look over the different columns, we see no real patterns which promise success. We may either have NO elements or answers which perform well, or more likely, we are dealing with a variety of populations with different proclivities and ideas that they prefer. These groups may cancel each other so what one group really likes, the other groups in the same population dislike. The result is a cancellation.

Looking at Self-Defined Subgroups of Respondents Using the Stringent Criterion of Acceptance

When we divide the respondents by WHO they say they are, we end up with two genders (male versus female), two ages (younger, < 30, older > 29)), and on group who says they are foodies. All groups are small. Yet, the Mind Genomics approach is sufficiently powerful with its permuted experimental designs to reveal the additive constant and the key elements for each group. We use the stringent criterion (rating of 9 recoded to 100, ratings of 1–8 recoded to 0.)

Table 3 shows that the basic acceptance of the vegetable muffin is equal among genders (additive constant is 24 for males, 21 for females), higher for the younger respondents (35 for younger versus 15 for the older respondents.) Finally, the acceptance of a vegetable muffin is higher among those respondents who label themselves ‘foodies’ (additive constant = 42, a very high level of basic interest.)

Table 3. Performance of the 16 elements by total panel, key self-defined subgroups, and by emergent mind-sets. The coefficients are taken from the Top1 model (ratings of 9 transformed to 100, other ratings transformed to 0). The development target is Mind-Set 2.

|

|

|

Total |

Male |

Female |

Younger |

Older |

Foodie |

Mind-Set 1 |

Mind-Set 2 |

|

|

Base size |

25 |

13 |

12 |

31 |

12 |

15 |

10 |

5 |

|

|

Additive constant |

25 |

24 |

21 |

35 |

15 |

42 |

30 |

22 |

|

C4 |

Convenient on-the-go snack |

6 |

6 |

5 |

11 |

1 |

9 |

4 |

5 |

|

D2 |

Made from the ingredients found in your own kitchen |

4 |

4 |

5 |

2 |

5 |

7 |

4 |

5 |

|

D1 |

Real food created by mom and real baker |

1 |

1 |

4 |

-2 |

5 |

3 |

2 |

-1 |

|

A3 |

Vegetables are very healthful for you |

1 |

0 |

4 |

0 |

2 |

2 |

0 |

2 |

|

A4 |

Vegetables prevent health problems |

1 |

-2 |

7 |

-2 |

3 |

1 |

-4 |

8 |

|

A1 |

Sustainable, better for you and better for the earth |

1 |

2 |

1 |

0 |

1 |

1 |

-3 |

6 |

|

A2 |

Vegetables are delicious |

0 |

1 |

-1 |

-3 |

3 |

-2 |

0 |

-1 |

|

C2 |

A delicious way to great health |

0 |

4 |

-3 |

0 |

1 |

0 |

2 |

-5 |

|

C3 |

Healthy as delicious for every eating occasion |

-1 |

9 |

-11 |

-1 |

0 |

-2 |

-1 |

-3 |

|

C1 |

Lovingly created vegetable baked snacks |

-1 |

6 |

-9 |

0 |

-2 |

-3 |

-2 |

-2 |

|

D4 |

This is gluten-free and all-natural |

-2 |

-2 |

-1 |

-9 |

5 |

-2 |

-4 |

2 |

|

B2 |

Think healthy, think muffin |

-2 |

0 |

-3 |

-5 |

1 |

-6 |

-4 |

-1 |

|

D3 |

Customized in four flavors: cauliflower, chocolate pomegranate, carrot morning glory, garden vegetable |

-3 |

-7 |

2 |

-9 |

3 |

-2 |

-5 |

0 |

|

B4 |

Vegetables for all ages |

-4 |

3 |

-7 |

-11 |

2 |

-8 |

-7 |

-3 |

|

B3 |

Global and adventurous eating |

-4 |

-6 |

0 |

-7 |

-2 |

-8 |

-9 |

1 |

|

B1 |

Delicious to eat and good for your body |

-5 |

0 |

-6 |

-9 |

-1 |

-8 |

-6 |

-5 |

Looking at the pattern of coefficients, the data suggest two messages for the product:

A convenience message, emphasizing a ‘convenient, on the go snack’. This positioning should appear to the total panel, but especially appeal to the younger respondent, and the respondent who considers him or her a ‘foodie.’

A ‘home’ and ‘health’ orientation, emphasizing that the product is ‘made from the ingredients found in your own kitchen.’ This phrasing can be elaborated for health but must be done so with care.

Dividing Respondents by Mind-Sets

One of the tenets of Mind Genomics is that in any topic where human judgment is important, there are different patterns of judgment, based upon the way individuals value the various aspects of the situation. Thus, in a product, one may focus on convenience, whereas another may focus on price, and a third may focus on nutrition, etc.) These mind-sets emerge by a statistical analysis of the results, clustering, which looks at the pattern of coefficients, and puts the respondents into a small set of mutually exclusive and exhaustive groups, mind-sets [17]. The coefficients show how the respondent weights the different pieces of information to drive a rating. Thus, clustering the individuals on the basis of the pattern of their 16 coefficients for the specific product of vegetable muffin reveal new, presumably more coherent subgroups. The individuals in a mind-set are presumed to show the same pattern, again for the specific product being developed. Mind Genomics works at the level of the very specific and does not requiring an armory of hypothetical constructs to move from general psychographic segmentation to the mind-sets pertaining to a vegetable muffin. Traditional psychographic segmentation misses the link from the general to thea particular [18].

Table 3 suggests that with our small sample of 25 respondents two clusters emerge. These are the two mind-sets. The two mind-sets show equal, moderate acceptance of the basic idea of the vegetable. Mind-Set 1 cannot be easily appealed to. Mind-Set 2, however, shows strong reactions to health and sustainability, Mind-Set 2 seems to be more coherent in what they like. They may not like the product more, but they give a sense of being more coherent, and possibly easier to reach. Thus Mind-Set 2 is the logical target to satisfy.

What Engages the Reader – Analysis of Response Times

Beyond the ratings one can get an idea of what messages engage the reader, and what messages the reader simply discards, passing over the message. Typically, the process of reading and deciding happens quickly, within a few seconds. It is virtually impossible for the respondent to ‘know’ how much time is spend engaged in reading. Yet, the systematic variation of the combinations coupled with a measure of overall response times enables the researcher to estimate how many tenths of seconds of one’s response time can be allocated to each of the elements or messages in the vignette.

The approach to understand response times follows that used to relate the presence/absence of the 16 elements to the ratings (e.g., Top 3, Top 2 or Top 1 rating.) The key differences are:

- The first vignette evaluated by each respondent is removed from the analysis. Other studies, as well as this, suggest that the respondents ‘learn’ what to do when rating the first vignette. Their response time may be artificially longer, but they are unaccustomed to the study. Respondents become accustomed quite quickly, so by the second vignette they are virtually ‘up to speed’ on what to do. The analysis removed this first vignette, leaving 23 vignettes evaluated by each respondent.

- All vignettes with response times exceed 9 seconds are removed. This precautionary action ensured that the remaining data reflected situations wherein the respondent was actually reading the vignette, whether paying attention to the messages or not.

- The result of the steps 1 and 2 above generated a data set comprising 534 observations, rather than the original 600.

- The model linking response time (seconds) to the presence/absence of the elements was estimated using OLS regression. The model is the same as the linear equation estimated for the rating of interest, except that there is no additive constant. The equation is expressed as: Response Time = k1(A1) + k2(A2)…k16(D4)

- The coefficients give a sense of the number of seconds spend by a typical respondent in the subgroup to ‘read’ the element in the vignette.

- Table 4 presents the coefficients for the different response times, for each element, by each key subgroup.

Table 4. Response times, defined as the linkage between the number of seconds estimated to be spent ‘reading’ each of the 16 different elements.

|

|

|

Total |

Male |

Female |

Younger |

Older |

Foodie |

Mind-Set 1 |

Mind-Set 2 |

|

|

Average Response Time |

0.9 |

1.0 |

0.8 |

0.6 |

1.2 |

0.8 |

0.8 |

1.0 |

|

B3 |

Global and adventurous eating |

1.4 |

1.5 |

1.5 |

0.8 |

1.9 |

1.4 |

0.9 |

2.1 |

|

C1 |

Lovingly created vegetable baked snacks |

1.2 |

1.4 |

0.8 |

0.9 |

1.7 |

1.1 |

0.8 |

1.7 |

|

B2 |

Think healthy, think muffin |

1.1 |

1.2 |

1.0 |

0.8 |

1.4 |

1.0 |

0.8 |

1.4 |

|

B4 |

Vegetables for all ages |

1.1 |

0.9 |

1.5 |

0.6 |

1.6 |

1.1 |

0.7 |

1.6 |

|

C3 |

Healthy as delicious for every eating occasion |

1.0 |

1.2 |

0.8 |

0.3 |

1.9 |

0.4 |

0.8 |

1.3 |

|

B1 |

Delicious to eat and good for your body |

1.0 |

1.1 |

1.0 |

0.5 |

1.5 |

0.9 |

0.6 |

1.4 |

|

D3 |

Customized in four flavors: cauliflower, chocolate pomegranate, carrot morning glory, garden vegetable |

1.0 |

0.9 |

1.0 |

0.8 |

1.3 |

0.7 |

0.9 |

1.2 |

|

D2 |

Made from the ingredients found in your own kitchen |

0.9 |

0.8 |

0.9 |

1.1 |

0.7 |

1.1 |

0.6 |

1.3 |

|

C2 |

A delicious way to great health |

0.9 |

0.8 |

0.9 |

0.8 |

1.1 |

0.8 |

1.1 |

0.5 |

|

C4 |

Convenient on-the-go snack |

0.8 |

0.7 |

1.0 |

0.7 |

1.0 |

0.6 |

0.9 |

0.7 |

|

A4 |

Vegetables prevent health problems |

0.8 |

1.0 |

0.4 |

0.7 |

0.7 |

1.0 |

1.1 |

0.3 |

|

D1 |

Real food created by mom and real baker |

0.8 |

0.9 |

0.6 |

0.8 |

0.9 |

0.6 |

0.7 |

1.1 |

|

D4 |

This is gluten-free and all-natural |

0.7 |

0.8 |

0.5 |

0.5 |

1.2 |

0.6 |

0.8 |

0.9 |

|

A1 |

Sustainable, better for you and better for the earth |

0.7 |

0.8 |

0.6 |

0.4 |

1.0 |

0.9 |

0.8 |

0.6 |

|

A3 |

Vegetables are very healthful for you |

0.6 |

0.6 |

0.6 |

0.1 |

0.9 |

0.6 |

0.7 |

0.4 |

|

A2 |

Vegetables are delicious |

0.4 |

0.7 |

0.1 |

0.1 |

0.7 |

0.4 |

0.5 |

0.3 |

The results from this small-scale study are again enlightening.

- On average, the typical time for an element is 0.9 seconds

- Men and women spend about equal time reading the elements (1.0 seconds for males, 0.8 seconds for females.)

- Older respondents spend longer time, on average, than do younger respondents (1.2 seconds versus 0.6 seconds.)

- Foodies spend an average amount of time, overall, reading the elements as do the two mind-sets.

- The elements differ dramatically in their ability to engage. For example, ‘Global and adventurous eating’ takes up 1.4 seconds on average, and among older respondents takes up 1.9 seconds, and among Mind-Set2 takes up 2.1 seconds. In contrast’ ‘Vegetables are delicious’ and ‘Vegetables are healthful for you’ appear to be glossed over by every but males and older respondents.

- Engagement does not predict interest, however. Just because a message engages and takes longer to read does not mean that the message will drive acceptance. For example, the two messages driving strong responses among Mind-Set2 (Vegetables prevent health problems; Sustainable, better for you and better for the earth) are not engaging in terms of time spent.

- In the development of stronger ideas from new products, engagement, perhaps time spent in focus groups, may not be an automatic indicator that the idea will be motivating.

Finding Mind Sets

One of the key benefits of Mind Genomics is its ability to uncover new-to-the world mind-sets, groups of people with similar ways of looking at the world. Traditionally, the notion of segmentation, dividing people, has implied collecting the data from hundreds, and now thousands of respondents, based upon either questionnaires, or more frequently now, purchase behavior recorded on the web, or in a loyalty program. From that often-expensive enterprise comes a way to identify people, either by asking them a set of questions or by observing their behavior patterns and assigning them to a segment.

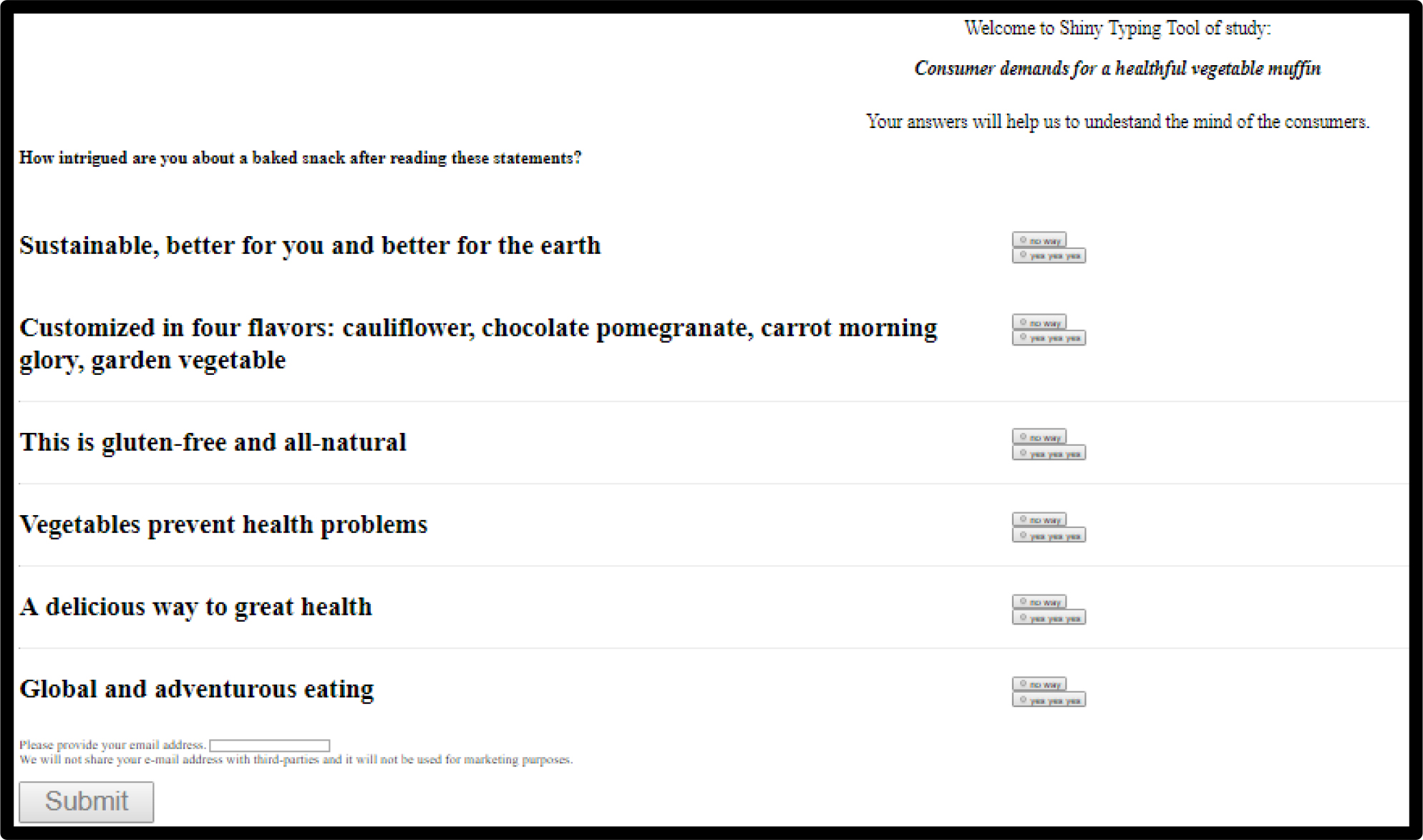

We deal here with 25 respondents, for a limited product, muffin, at the very early conceptual stages. Despite that, we see that there are two mind-sets, at least in this very early study. How then do we find people in Mind-Set2, our potential group? People don’t wear signs on their foreheads announcing the mind-set to which they belong, and even if they did, we can always come up with new-to-the-world products which have no history on which to create segments, clusters. Table 5 shows that the two mind-sets distribute across gender, age, and even self-defined food preferences (here ‘Foodie.’) The answer is NOT more respondents, although that might be the reflex response. Instead of 25 respondents, we could opt for 2500 respondents, but we are likely to get similar distributions. Another way of thinking about the problem is needed. Rather, the answer is a way to identify people as members of the appropriate mind-set, either in the development of the new product, sampling of the new product in stores, or mass advertising, respectively.

Table 5. Distribution of the two mind-sets in the population of 25 respondents.

|

|

Total |

Mind-Set 1 |

Mind-Set 2 (Target) |

|

Total |

25 |

15 |

10 |

|

Male |

13 |

8 |

5 |

|

Female |

12 |

7 |

5 |

|

Young |

13 |

8 |

5 |

|

Old |

12 |

7 |

5 |

|

Foodie |

15 |

10 |

5 |

The best way to find new mind-sets, in an efficient manner, matching the speed and cost of the basic study, creates simple PVI, personal viewpoint identifier. We know the mind-sets from the study, and we know how the different mind-sets react to the elements. We can create a set of six questions, with two possible answers to each, such that the pattern of the answers (all 64 patterns) will suggest that the person completing the PVI will be a member of Mind-Set2 (the target for development and marketing), or Mind-Set1 (not the target.)

Figure 2 shows the PVI created for this small study. As of this writing (June, 2019) the PVI resides at http://162.243.165.37:3838/TT36/

Figure 2. The Personal Viewpoint Identifier (PVI) for the vegetable muffin, showing the six questions. The pattern of answers assigns the respondent to Mind-Set1 or Mind-Set 2.

It is worth reiterating that the spirit of the project is to identify a potential product opportunity. This paper shows the possibility of using powerful techniques to understand product opportunities and people, not at the end of development where the decisions have been made and the costs of failure are high, but rather at the very beginning of the development project, where the structured approach provides the beginning of a roadmap. One could imagine using the PVI to identify those likely to be in Mind-Set2, and then working with to define the appropriate product features, and most effective advertising messages.

Discussion and Conclusion

The origin of this study was from a discussion about the best way to create a new idea in a product category.

Traditional methods included ideation (e.g., brainstorming), promise testing, concept testing, concept optimization, along with very expensive product/concept tests, and even predictions of market share such as BASES [19,20].

The foregoing methods are long, cumbersome, expensive, and ultimately oriented to the clerical and purchasing function. What started out as a method to create ideas for new products has ended up being a choke on ideas, such as the vaunted methods of Stage Gate [2], and the standardized practices of past and current giants such as General Foods, Kraft Foods, Procter & Gamble, and so forth. These steps have been codified into best practices, with appropriate activities, norms, and so forth, until s create a climate of fear and risk aversion, preventing the corporation from actually coming up with new products. The ‘process becomes the product, the product itself almost forgotten as the process takes over, perhaps analogous to the way the parasite subvert the biological processes of its host.’

In recent years, beginning about 20years ago, there has been a movement away from these large-scale, risk reduction processes, towards so-called agile development [21–23].

There is still the ever-present fear of failure in corporations, counterbalanced by the often totally ‘seat of the pants’ efforts by entrepreneurs who have abandoned or who cannot afford such best practices in the formulation of that idea. The method here, fast, inexpensive, powerful, based on an APP, and done in 2–4 hours at low cost, scalable, and iterative if necessary, presents a new vision of what could be accomplished when thinking, rather than process, is given a ‘technical tool for creative thought’ (personal communication from Anthony Oettinger, March, 1965, to Howard Moskowitz.) The approach relies upon what Kahneman [24] has called ‘System 1,’ the intuitive, rapid, almost automatic system by which we make most of our daily decisions. As a historical aside, it is worth noting that the approach, developed originally by author Moskowitz, comes from some thoughts in originating in the 1960’s, when influenced by Oettinger’s vision, and Kahneman’s through the latter’s research partner, the late Amos Tversky.

Acknowledgment

Attila Gere thanks the support of the Premium Postdoctoral Researcher Program of the Hungarian Academy of Sciences.

References

- Cooper RG (1979) the dimensions of industrial new product success and failure. Journal of marketing 43: 93–103.

- Cooper RG (1990) Stage-gate systems: a new tool for managing new products. Business horizons 33: 44–54.

- Cooper, Robert G (2016) Agile–Stage-Gate Hybrids: The Next Stage for Product Development Blending Agile and Stage-Gate methods can provide flexibility, speed, and improved communication in new-product development. Research-Technology Management 59: 21–29.

- Dora M, Van Goubergen D, Kumar M, Molnar A, Gellynck X (2014) Application of lean practices in small and medium-sized food enterprises. British Food Journal 116: 125–141.

- Herstatt C and Von Hippel E (1992) From experience: Developing new product concepts via the lead user method: A case study in a “low-tech” field. Journal of product innovation management 9: 213–221.

- Thomke S, Reinertsen D (1998) Agile product development: Managing development flexibility in uncertain environments. California management review 41: 8–30.

- Moskowitz HR (2012) ‘Mind genomics’: The experimental inductive science of the ordinary, and its application to aspects of food and feeding. Physiology & Behavior 107: 606–613.

- Moskowitz HR, Gofman A (2007) Selling blue elephants: How to make great products that people want before they even know they want them. Pearson Education.

- Moskowitz HR, Gofman A, Beckley J and Ashman H (2006) Founding a new science: Mind genomics. Journal of sensory studies 21: 266–307.

- Luce RD, Tukey, JW (1964) Simultaneous conjoint measurement: A new type of fundamental measurement. Journal of mathematical psychology 1: 1–27.

- Box GE, Hunter WG, Hunter JS (1978) Statistics for experimenters. New York, John Wiley.

- Green PE and Rao VR (1971) Conjoint measurement for quantifying judgmental data. Journal of marketing research 8: 355–363.

- Green PE, Srinivasan V (1990) Conjoint analysis in marketing: new developments with implications for research and practice. The journal of marketing 54: 3–19.

- Moskowitz HR, Gofman A, Itty B, Katz R, Manchaiah M, Ma Z (2001) Rapid, inexpensive, actionable concept generation and optimization: the use and promise of self-authoring conjoint analysis for the food service industry. Food Service Technology 1: 149–167.

- Gofman A, Moskowitz H (2010) Isomorphic permuted experimental designs and their application in conjoint analysis. Journal of Sensory Studies 25: 127–145.

- Moskowitz H, Gofman A, I novation Inc (2003) System and method for content optimization. U.S. Patent 6,662,215.

- Dubes R, Jain AK (1980) Clustering methodologies in exploratory data analysis. Advances in Computers, 19, 113–238.

- Wells WD ed., 2011. Life Style and Psychographics, Chapter 13: Life Style and Psychographics: Definitions, Uses, and Problems. Marketing Classics Press.

- Hanssens DM (2016) what is known about the long-term impact of advertising. In Accountable Marketing (pp. 120–137). Routledge.

- Rawlinson JG (2017) Creative thinking and brainstorming. Routledge.

- Kessler EH, Chakrabarti AK (1999) Speeding up the pace of new product development.” Journal of Product Innovation Management 16: 231–247.

- Lehtinen U, Torkko M (2005) The lean concept in the food industry: A case study of contract a manufacturer. Journal of Food Distribution Research 36: 57.

- Zarei M, Fakhrzad MB, Paghaleh MJ (2011) Food supply chain leanness using a developed QFD model. Journal of food engineering 102: 25–33.

- Kahneman D and Egan P (2011) Thinking fast and slow. New York: Farrar, Straus and Giroux.